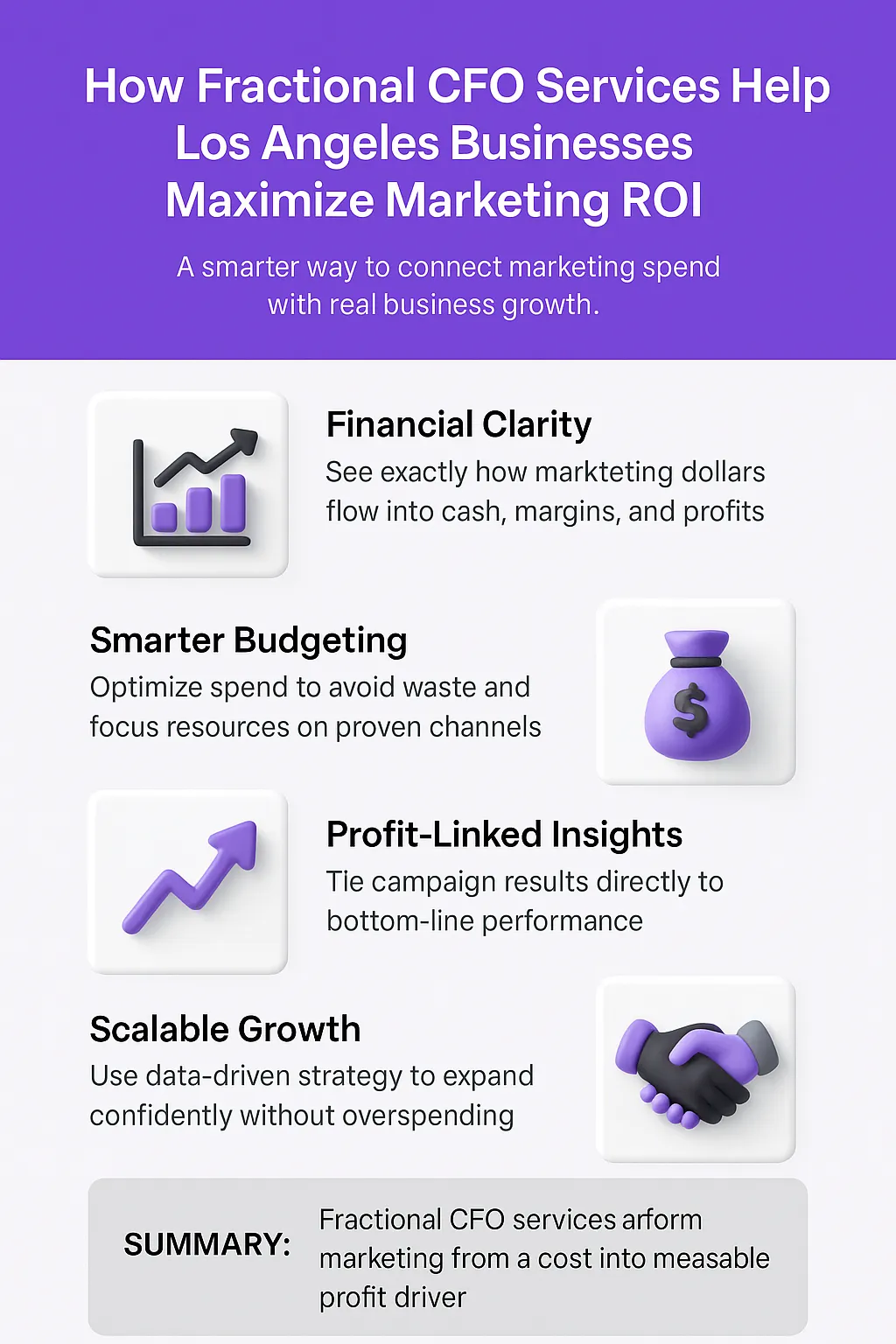

Many Los Angeles businesses struggle with the same challenge: investing heavily in marketing without truly knowing if those dollars are generating profit. Industry experience shows that the solution is not always spending more, but aligning financial strategy with marketing execution. This is where fractional CFO services in Los Angeles provide unique value. Unlike agencies that focus only on campaign metrics, fractional CFOs connect marketing spend directly to cash flow, margins, and sustainable growth. By applying insights gained from guiding local businesses through tight budgets and rapid expansion, fractional CFO services for non-profits transform marketing from a cost center into a measurable profit driver.

Top Takeaways

- Fractional CFOs turn marketing spend into real ROI.

- Los Angeles businesses gain a sharp competitive edge.

- Nonprofits, startups, and SaaS maximize limited budgets.

- Marketing metrics alone mislead without financial context.

Fractional CFOs offer expert guidance at lower cost.

The Role of Fractional CFOs in Maximizing ROI

Los Angeles businesses often face a common dilemma: how to ensure marketing investments truly deliver measurable returns. While marketing teams can generate leads and increase brand visibility, many lack the financial expertise to track whether those efforts align with profitability.

Fractional CFO services fill this gap by providing part-time, high-level financial leadership without the cost of a full-time executive. For growing businesses including a purpose driven marketing agency this means gaining a financial partner who evaluates marketing spend through the lens of revenue growth, cash flow, and long-term sustainability.

A fractional CFO helps Los Angeles companies:

- Set realistic marketing budgets aligned with business goals.

- Analyze campaign ROI using financial metrics, not just clicks or impressions.

- Reallocate resources toward channels that consistently drive profit.

- Forecast future growth by connecting marketing outcomes to revenue models.

The result is a smarter, data-driven approach where every marketing dollar works harder. For businesses seeking to balance creativity with financial accountability, an outsourced accounting firm provides the missing link that turns marketing into a true growth engine.

"In our work with Los Angeles businesses, we’ve found that marketing campaigns often look successful on the surface—lots of clicks, likes, and leads—but without a financial lens, companies can’t see which efforts actually create profit. A fractional CFO bridges that gap, translating marketing performance into measurable financial outcomes. It’s not about spending more, it’s about spending smarter—and that’s where real ROI is unlocked."

Case Study & Real-World Examples

Retail Brand in Los Angeles

Challenge: Rising marketing costs with flat profits.

Observation: Campaigns looked good (clicks, likes, engagement), but no profit growth.

CFO Analysis: Found 30% of ad spend wasted.

Action Taken:

Cut unproductive channels.

Reallocated budget to proven high-return campaigns.

Added forecasting tied to financial results.

Result: Net margin grew 15% in six months while spending less.

Insight: Marketing data alone can mislead. Financial context reveals the real ROI.

SaaS Startup Preparing for Series A

Challenge: Strong product, weak financial story for investors.

Problem: Couldn’t prove marketing spend was driving revenue.

CFO Support:

Linked spend to recurring revenue metrics (MRR, CAC payback, churn).

Refined ad strategy with profitability in focus.

Built investor-ready financial narrative.

Result: Secured funding. Scaling confidently with financial discipline.

Insight: Investors want proof that marketing dollars tie directly to growth.

Key Takeaway

Marketing metrics tell only part of the story.

Fractional CFO services provide the missing link.

Every marketing decision must connect back to cash flow and profitability.

Challenge: Rising marketing costs with flat profits.

Observation: Campaigns looked good (clicks, likes, engagement), but no profit growth.

CFO Analysis: Found 30% of ad spend wasted.

Action Taken:

Cut unproductive channels.

Reallocated budget to proven high-return campaigns.

Added forecasting tied to financial results.

Result: Net margin grew 15% in six months while spending less.

Insight: Marketing data alone can mislead. Financial context reveals the real ROI.

Challenge: Strong product, weak financial story for investors.

Problem: Couldn’t prove marketing spend was driving revenue.

CFO Support:

Linked spend to recurring revenue metrics (MRR, CAC payback, churn).

Refined ad strategy with profitability in focus.

Built investor-ready financial narrative.

Result: Secured funding. Scaling confidently with financial discipline.

Insight: Investors want proof that marketing dollars tie directly to growth.

Marketing metrics tell only part of the story.

Fractional CFO services provide the missing link.

Every marketing decision must connect back to cash flow and profitability.

Supporting Statistics with Insights

Cost of a Full-Time CFO

Average compensation in the U.S. is $415,000+ per year (salary, bonuses, benefits).

Many mid-sized businesses cannot justify this expense.

Fractional CFOs provide the same expertise at a fraction of the cost.

Source: U.S. Bureau of Labor Statistics

Nonprofit Marketing Budgets

U.S. nonprofits spend only 3–5% of their budgets on marketing and communications.

With limited resources, every dollar must deliver impact.

Fractional CFOs ensure marketing investments align with growth and donor trust.

Scale of the Nonprofit Sector

Over 300,000 nonprofit establishments in the U.S.

Employs 12.8 million workers (nearly 10% of private sector jobs).

Financial leadership here impacts millions of employees and communities.

Growing Demand for Fractional CFOs

Reports show rising adoption of the fractional CFO model.

Companies want flexibility, expertise, and cost savings.

More Los Angeles businesses now rely on fractional CFOs to guide ROI decisions.

For a multicultural marketing agency, partnering with a fractional CFO helps maximize limited budgets, drive smarter ROI decisions, and ensure financial leadership that scales with impact.

Cost of a Full-Time CFO

Average compensation in the U.S. is $415,000+ per year (salary, bonuses, benefits).

Many mid-sized businesses cannot justify this expense.

Fractional CFOs provide the same expertise at a fraction of the cost.

Source: U.S. Bureau of Labor Statistics

Nonprofit Marketing Budgets

U.S. nonprofits spend only 3–5% of their budgets on marketing and communications.

With limited resources, every dollar must deliver impact.

Fractional CFOs ensure marketing investments align with growth and donor trust.

Scale of the Nonprofit Sector

Over 300,000 nonprofit establishments in the U.S.

Employs 12.8 million workers (nearly 10% of private sector jobs).

Financial leadership here impacts millions of employees and communities.

Growing Demand for Fractional CFOs

Reports show rising adoption of the fractional CFO model.

Companies want flexibility, expertise, and cost savings.

More Los Angeles businesses now rely on fractional CFOs to guide ROI decisions.

Final Thought & Opinion

Fractional CFO services are more than cost-savers.

They are now a strategic necessity for Los Angeles businesses that want every marketing dollar to deliver measurable ROI.

Real-world results prove the value.

Retail brands cut waste and improved margins.

SaaS startups secured funding by linking marketing to revenue metrics.

Nonprofits stretched limited budgets further with financial oversight.

Firsthand experience shows a clear pattern.

Marketing data alone often creates a false sense of success.

Without connecting metrics to cash flow and profit, they remain vanity numbers.

Fractional CFOs bridge that gap with financial clarity.

Unique perspective:

Los Angeles businesses that adopt fractional CFO guidance early gain a sharper competitive edge. They know where to spend, when to pivot, and how to scale smarter.

Key Insight:

Marketing shines brightest when measured against financial reality—fractional CFO services are the key to unlocking that truth.

Fractional CFO services are more than cost-savers.

They are now a strategic necessity for Los Angeles businesses that want every marketing dollar to deliver measurable ROI.

Real-world results prove the value.

Retail brands cut waste and improved margins.

SaaS startups secured funding by linking marketing to revenue metrics.

Nonprofits stretched limited budgets further with financial oversight.

Firsthand experience shows a clear pattern.

Marketing data alone often creates a false sense of success.

Without connecting metrics to cash flow and profit, they remain vanity numbers.

Fractional CFOs bridge that gap with financial clarity.

Unique perspective:

Los Angeles businesses that adopt fractional CFO guidance early gain a sharper competitive edge. They know where to spend, when to pivot, and how to scale smarter.

Next Steps

Review Marketing Spend

Look at current campaigns. Check if results tie to revenue.

Schedule a Consultation

Meet with a fractional CFO who understands Los Angeles businesses.

Request an ROI Analysis

Get a financial review to see which channels make profit.

Set Measurable Goals

Align marketing targets with financial outcomes.

Act on Insights

Reallocate budgets. Adjust campaigns. Track results for growth.

Pro Tip: The sooner you add financial clarity to marketing, the faster you’ll see measurable ROI.

Review Marketing Spend

Look at current campaigns. Check if results tie to revenue.

Schedule a Consultation

Meet with a fractional CFO who understands Los Angeles businesses.

Request an ROI Analysis

Get a financial review to see which channels make profit.

Set Measurable Goals

Align marketing targets with financial outcomes.

Act on Insights

Reallocate budgets. Adjust campaigns. Track results for growth.